accumulated earnings tax irs

EIN if any Reference ID number see instructions a. Accumulated earnings tax irs Friday May 20 2022 Edit.

How Corporations May Run Afoul Of The Accumulated Earnings Tax A Section 1202 Planning Brief Frost Brown Todd Full Service Law Firm

The tax rate is 20 of accumulated taxable in-come defined as taxable income with adjustments including the subtraction of federal and foreign income taxes.

. When the revenues or profits are above this level the firm will be subjected to accumulated earnings tax if they do not distribute the dividends to shareholders. The accumulated earnings tax is a 20 penalty that is imposed when a corporation retains earnings beyond the reasonable needs of its business ie instead of paying dividends with the purpose of avoiding shareholder - level tax seeSec. A personal service corporation PSC may accumulate earnings up to 150000 without having to pay this tax.

An IRS review of a business can impose it. The AET is a penalty tax imposed on corporations for unreasonably accumulating earnings. The accumulated earnings tax also called the accumulated profits tax is a tax on abnormally high.

Metro Leasing and Development Corp. If the accumulated earnings tax applies interest applies to the tax from the date the corporate return was originally due without extensions. The main focus in an IRS proposal of tax here is usually the accumulated earnings credit which for other than a mere holding or investment company primarily turns on the reasonable needs of the business Section 535c1.

If a corporation accumulates earnings that exceed the exemption amounts an accumulated earnings tax of 20 15 prior to 2013 of the excess earnings may be assessed. 1120 or Schedule M-3 Form 1120 for the tax year also attach a schedule of the differences between the earnings and. Breaking Down Accumulated Earnings Tax.

There is a certain level in which the number of earnings of C corporations can get. A corporation can accumulate its earnings for a possible expansion or other bona fide business reasons. Publication 542 012019 Corporations - IRS tax forms.

The Accumulated Earnings Tax is computed by multiplying the Accumulated Taxable Income IRC Section 535 by 20. The tax is in addition to the regular corporate income tax and is assessed by the IRS typically during an IRS audit. Also called the accumulated profits tax it is applied when tax authorities determine the cash on hand to be an excessively high amount.

According to the IRS anything. IRC 532 a states that the accumulated earnings tax imposed by IRC 531 shall apply to every corporation other than those described in subsection IRC 532b formed or availed of for the purpose of avoiding the income tax with respect to its shareholders or the shareholders of any other corporation by permitting earnings and profits to accumulate instead of being. Tax Rate and Interest.

Attach to Form 5471. The Accumulated Earnings Tax is more like a penalty since it is assessed by the IRS often years after the income tax return was filed. The purpose of the tax.

The point of this tax is to encourage companies to issue dividends to their shareholders rather than sit on the earnings which ironically often leads to the shareholders paying taxes on the. Name of foreign corporation. And there is permitted usually a 250000 minimum accumulation of earnings.

However if a corporation allows earnings to accumulate beyond the reasonable needs of the business it may be subject to. The threshold is 25000 without accumulated earning tax. Accumulated Earnings Tax can be reduced by reducing Accumulated Taxable Income.

The accumulated earnings tax is imposed on the accumulated taxable income of every corporation formed or availed of for the purpose of avoiding the income tax with respect to its shareholders by permitting earnings and profits to accumulate instead of being divided or distributed. The purpose of accumulated earning tax is to discourage the accumulation of profits if the purpose of such accumulation is to enable shareholders to avoid paying taxes on those profits by not paying them dividends. The tax rate on accumulated taxable income currently stands at 20 and fortunately the American Taxpayer Relief Act ATRA kept it from rising to a.

The accumulated earnings tax imposed by section 531 shall apply to every corporation other than those described in subsection b formed or availed of for the purpose of avoiding the income tax with respect to its shareholders or the shareholders of any other corporation by permitting earnings and profits to accumulate instead of being divided or distributed. To prevent companies from doing this Congress adopted the excess accumulated earnings tax provision of IRC section 535. The accumulated earnings tax is a charge levied on a companys retained earnings.

A corporation may be allowed an accumulated earnings credit in the na-ture of a deduction in computing accu-mulated taxable income to the extent it. How Does Accumulated Earnings Tax Work. The regular corporate income tax.

To determine if the corporation is subject to this tax first treat an accumulation of 250000 or less generally as within the reasonable needs of most businesses. Keep in mind that this is not a self-imposed tax. 1545-0123 Name of person filing Form 5471.

Recently the Tax Court had an opportunity to consider the computation of this penalty tax. IRC Section 535c1 provides that. For instructions and the latest information.

Code 531 - Imposition of accumulated earnings tax. An accumulated earnings tax is a tax imposed by the federal government on corporations with retained earnings deemed to be unreasonable or unnecessary. In addition to other taxes imposed by this chapter there is hereby imposed for each taxable year on the accumulated taxable income as defined in section 535 of each corporation described in section 532 an accumulated earnings tax equal to 20 percent of the accumulated taxable income.

Accumulated Earnings Profits EP of Controlled Foreign Corporation. The tax rate on accumulated earnings is 20 the maximum rate at which they would be taxed if distributed. IRC 532 a states that the accumulated earnings tax imposed by IRC 531 shall apply to every corporation other than those described in subsection IRC 532b formed or.

In periods where corporate tax rates were significantly lower than individual tax rates an obvious. Filed its 1995 tax return showing a liability of 2674 which it paid in March 1996.

Bardahl Formula Calculator Defend Against Accumulated Earnings Tax

Understanding The Accumulated Earnings Tax Before Switching To A C Corporation In 2019

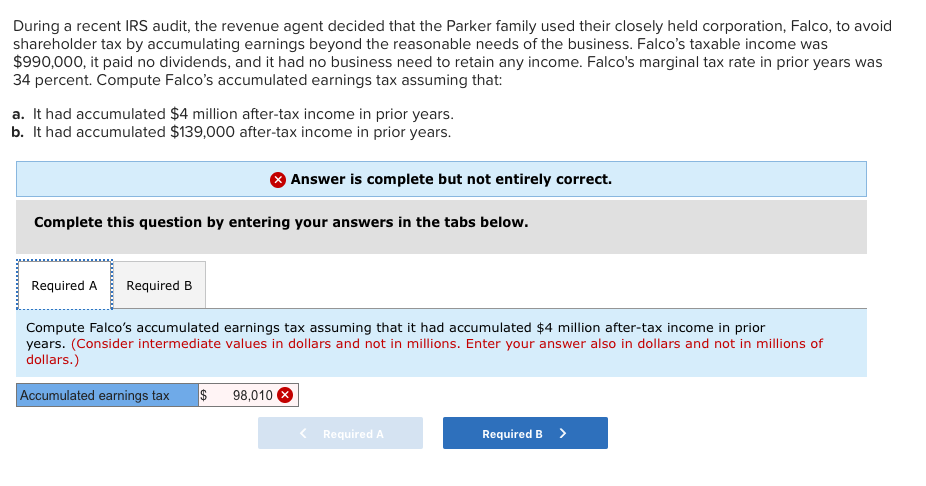

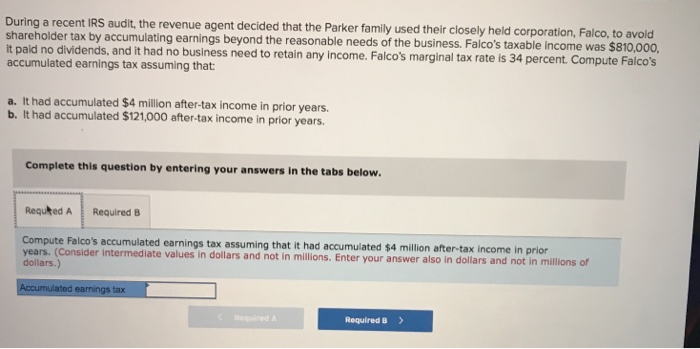

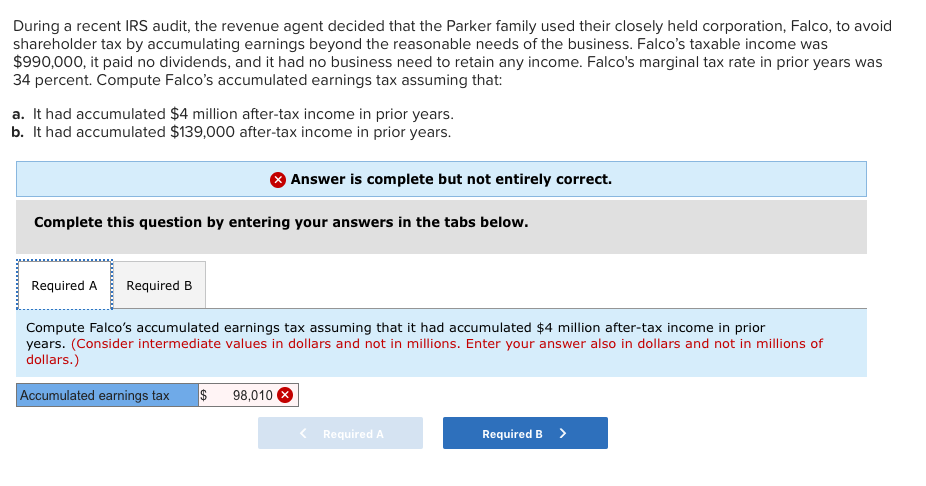

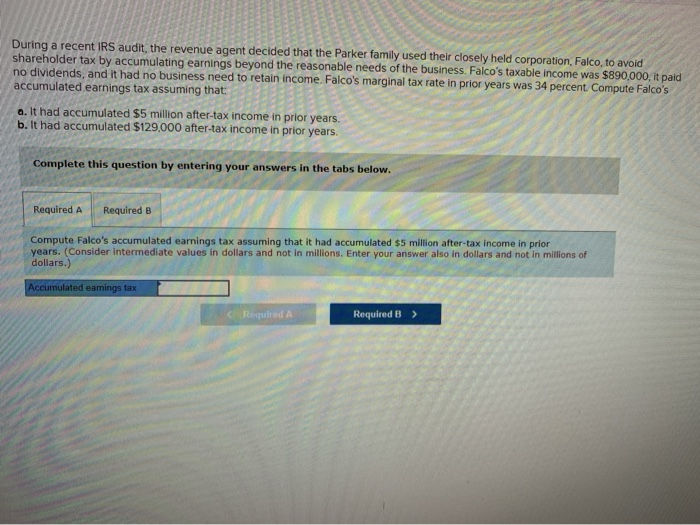

Solved During A Recent Irs Audit The Revenue Agent Decided Chegg Com

A Retained Earnings Statement Is Used By Accountants To Also Keep Track Of A Tax Payer S Accounts Sales Report Template Statement Template Report Template

Solved During A Recent Irs Audit The Revenue Agent Decided Chegg Com

Irs Use Of Accumulated Earnings Tax May Increase

Earnings And Profits Computation Case Study

Earnings And Profits Computation Case Study

Earnings And Profits Computation Case Study

Solved Determine Whether The Following Statements About The Chegg Com

Strategies For Avoiding The Accumulated Earnings Tax Krd Ltd

Demystifying Irc Section 965 Math The Cpa Journal

How To Calculate The Accumulated Earnings Tax For Corporations Universal Cpa Review

Solved During A Recent Irs Audit The Revenue Agent Decided Chegg Com